It won’t surprise anybody if you’re wondering, “Does OPay give loan?” These days, when money fits waka like a breeze, everyone needs an extra hand once in a while.

If you’re looking for sharp-sharp cash, OPay actually has a solution for you through their EasiMoni service. Let’s break down how OPay loans work so you’ll know what to expect and how to apply when money gets tight. Back to the question;

Table of Contents

Does OPay Give Loans?

Yes, OPay offers loans with EasiMoni right inside the app you might already be using. EasiMoni is designed to handle small, quick financial needs, unexpected bills, emergency expenses, or just that little “pepper” to hold you before payday. If you’ve got the OPay app, you’re halfway there!

How to get a loan from Opay

Here is a step-by-step guide on getting a loan with OPay’s EasiMoni service. It’s super convenient, so you don’t need to worry about long forms or collateral.

1. Download and Set Up the OPay App

If you don’t have the app, you can download it from the Google Play Store or Apple App Store. Once you register, you’re all set up for their services. You will required to fill in your BVN, NIN and other details to complete your Opay account creation.

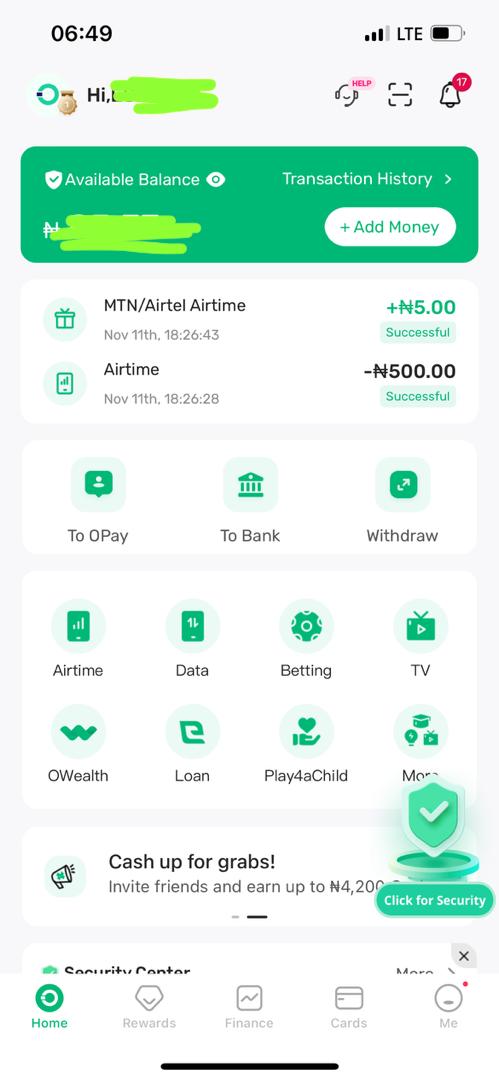

2. Click On Loan

Open the OPay app and look for the “Loan” icon. Once you click on it, a pop-up page will show, which is the EASIMONI service; this is the loan service within OPay. Click on it, and you’re ready to apply.

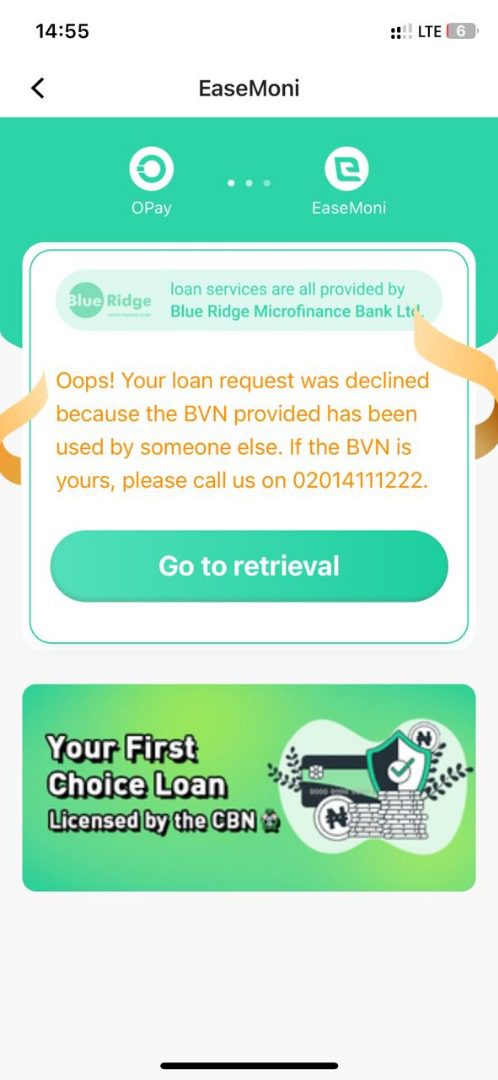

Note: Your BVN must tally with the number you use to register Opay to be able to use EASIMONI. Otherwise, you will not be eligible to use the service.

3. Pick Your Loan Amount

OPay loans are perfect for small to medium amounts. Think about school fees, unexpected repairs, or quick medical bills. Choose the amount you need, and make sure it’s something you’ll be comfortable repaying.

4. Review Interest Rates and Terms

Before finalizing, check the interest rate and repayment terms very well. OPay will show you the details upfront. Compare and ensure it’s something that fits your budget so you’re not surprised when it’s time to repay.

5. Submit Your Application

Once you’ve chosen your amount and reviewed the terms, go ahead and submit. Make sure you have updated your profile before applying for a loan. You need to provide some verification details like your BVN and contact info – but the process is straightforward and mostly automated.

6. Receive Your Cash

After approval, the cash goes straight into your OPay wallet or bank account. It’s usually instant so that you won’t be waiting around for hours or days.

Important Things to Know on EASIMONI

● BVN Phone Number Must be used For the application

Do not panic if the BVN does not tally; all you need to do is call the number that appears on the screen, just like the image above, to confirm the BVN is yours. With this, you can proceed to the next stage of the loan application.

● Loan Size:

EASIMONI loans are for quick cash needs so that you won’t be getting a massive sum. They’re ideal for short-term financial needs.

● Repayment Time:

Repay on time! Easimoni rewards users who pay promptly with higher amounts and possibly better terms on the next loan.

● Interest Rates:

Always double-check the interest rates. OPay loans are designed to be affordable, but comparing rates will help you avoid unnecessary stress. The interest rate varies per user activity

1. Does OPay give loan?

Yes, OPay offers loans through its EasiMoni service, which is available directly in the OPay app. It’s fast and convenient.

2. What exactly is EasiMoni?

EasiMoni is OPay’s loan feature, which is made for quick cash when you need it.d.

3. How do I apply for an EasiMoni loan?

Open the OPay app, click on the Loan icon, select EasiMoni, and follow the steps to apply. It’s straightforward!

4. What’s the smallest and largest loan amount I can get?

EasiMoni provides small to medium loan amounts, with limits based on your eligibility and borrowing history.

5. How much interest will I pay on an EasiMoni loan?

Interest rates vary depending on the loan amount and repayment period. You’ll see the rate displayed before you finalize your application.

6. How fast does EasiMoni disburse loans?

Once approved, your loan is disbursed almost instantly to your OPay wallet or linked bank account.

7. Do I need a high credit score to get approved?

EasiMoni considers different factors for approval, so even if your credit score isn’t perfect, you may still qualify.

8. Can I get a higher loan amount if I repay on time?

Yes! EasiMoni rewards users who repay promptly by increasing loan limits and offering better terms on future loans.

9. What happens if I miss a repayment?

Missing a payment may lead to extra charges, and it could impact your chances of borrowing again, so it’s best to repay on time.

10. Is EasiMoni available on both Android and iOS?

Absolutely! You can access EasiMoni loans through the OPay app on both Android and iOS devices.