Secure a loan in Nigeria without salary account! Explore 10 trusted apps with fast approvals & simple requirements. Borrow with ease now!

The current harsh Economic realities in Nigeria mean more and more Nigerians are being plunged into Economic hardship every day.

In most of these situations, loans can come in handy and help tackle some of the issues that require spending. Now, the problem is that getting a loan without a salary account is quite difficult.

A salary account is a special type of bank account that you can use to receive regular income or even salaries.

Most traditional banks often ask borrowers to have a salary account as it gives them confidence that such an account has a steady inflow of funds, meaning there will always be available funds to pay back.

Other traditional banks, most often than not, always prefer to lend money to those with a salary account because it shows they have clear sources of income that are reliable. However, if you don’t have a salary account, it becomes really difficult for you to get loans from them.

Another issue is that without a salary account, many people do not actually have a credit history or credit score. These, of course, are key things that most banks consider before giving out a loan. Without them, your chances of getting loans are slim.

So, what are your alternatives without a Salary Account? Well, that’s why I am here. I’ve arranged a list of options you can consider if you don’t have a salary account; these options will definitely give you the Loans you need.

Table of Contents

How to Secure a Loan in Nigeria Without Salary Account: Top 10 Options

1. Okash Loan App

Formerly owned and controlled by Fintech Banks Opay, Okash is an option you should consider if you are interested in getting a loan in Nigeria that doesn’t require you to have a salary account.

Okash is a popular Loan application that doesn’t require you to have a Salary Account or even BVN before getting a loan. Okash is currently under the control of Blue Ridge Microfinance Bank.

If you want to start borrowing money from Okash without getting bothered about whether you have a salary account or not, go to the Google Play store and download the Opay banking application. You should complete all the necessary registrations, navigate to the Okash section of the app and start borrowing the required funds that you need.

You can borrow from N2,000 to N500,000 on Okash. You should continually pay back in time so as to enjoy a better credit score. The more you pay back the loans you borrowed as of when due, the higher the increase in the amount you will borrow next time.

With Okash, you can borrow the amount that suits you best, provided you don’t default, you can always go back to them.

2. PalmCredit

Are you under any serious emergency that requires emergency funds and you don’t have any salary account? Don’t worry; Palmcredit will credit you as long as you meet their requirements.

Palm Credit is another beautiful Fintech App that has rescued lots of Nigerians who don’t have a salary account. As well as not requiring a salary account, you can also borrow from Palm Credit even if you don’t have any BVN.

To get started on Palmcredit, Download the app on any of the officially recognized Play Stores, fill in the necessary registrations and start borrowing money as soon as possible.

The minimum amount you can borrow on Palmcredit is N2,000. In contrast, you can borrow as much as N150,000 on Palmcredit provided you don’t default payment. You make your payments within the given time frame.

The interest rates of Palmcredit are good, so you don’t need to be worried about getting ripped off.

3. Alat Loan App By Wema

If you want to get steady loan alerts without a Salary Account, consider setting up an Alat Loan App owned by Wema Bank. You can easily get your loans on these apps without bothering if you have a salary account.

You can even be a student and wondering how to apply for a student loan, all you have to do is to make sure you meet all the requirements, and boom you’ll get your desired amount dancing in your bank account. Alat gives bulk of their loans to customers who already have a salary account.

However, they also reserved some substantial amounts of money for customers who don’t have a salary account. Alat gives a minimum of N5000 to customers looking to get a loan from them.

While the amount can rise to N1,000,000 provided you pay back your loans as when due. The more you pay, the higher the loan amounts you will get. So what are you waiting for? Set up your Alat account and start getting unlimited alerts to sort your bills.

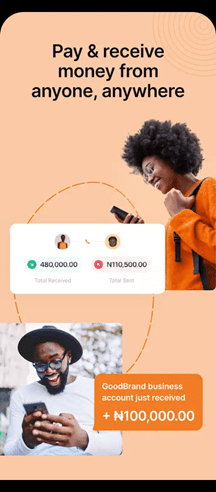

4. Palmpay Microfinance Bank

Palmpay is one of the most popular Digital banking apps in Nigeria, Millions of Nigerians use it for different banking transactions on a daily basis.

Palmpay has been dominating the Nigerian Fintech spaces alongside Opay for a while now. Unlike Nigeria’s traditional banks, you can easily borrow loans from Palmpay without even having a Salary Account.

Once you are qualified to borrow from Palmpay, You’ll be given loans that have really good interest rates. It would help if you were careful not to default payment, as Palmpay doesn’t take it lightly with those who refuse to pay back when due.

They can do lots of funny things to get back their money, so if you know you’re going to default, it’s better not to even consider borrowing from them. You can borrow a minimum of N3000 and up to One million Naira, as long as you don’t default payment.

Palmpay customer service and User interface are top notch, and there are lots of things you can easily do with Palmpay. Buying data and other subscriptions can be easily done with Palmpay.

So you see, you don’t only get to borrow money from them without a salary account. You’ll also have the opportunity to perform some other amazing tasks in the app.

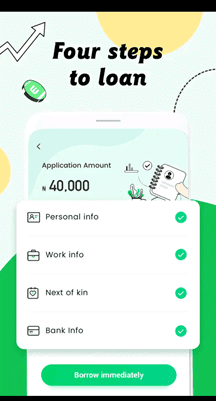

5. Ease Cash

Ease Cash is on the list of our top options for getting a loan in Nigeria without salary account. Ease Cash may be new to the Nigerian Fintech spaces, but they have doings and you can get a substantial amount of loan from them.

Ease Cash is highly rated; thousands of Nigerians have received Millions of Naira in Loans from the Fintech Bank; getting loans from them is certainly not a difficult thing to do; it can happen almost instantly.

Firstly, download the app and go through the normal settings by filling out your normal information. Then, you can start borrowing immediately.

For a start, you can borrow N2,000 as a minimum, as time goes on, You can borrow up to N350,000 so far as all of their requirements are met. They have an Annual Percentage Rate (APR) of about 14%; if you compare these amounts with other Apps, trust me, this is an absolute steal.

Their repayment plan is another reason Why so many people have come to fall in love with Ease Cash. You’ll have the grace of repaying within the periods of 90 to 180 days, meaning you have almost all the time to pay as long as possible.

Also, there’s absolutely no need for collateral; all you need is to be creditworthy, and you’ll continue to receive your loans.

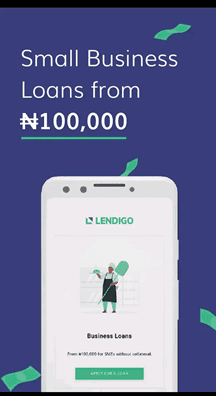

6. Lendigo

Lendigo has been lending people money from the word go. Lendigo is a leading Fintech bank in Nigeria with an amazing customer base; they’ve been quite competitive and dominant in the Fintech Market.

If you are looking for a substantial amount of loan in Nigeria without salary account, lendigo is your best bet. Unlike some Fintech apps, their loan maximum amount is always at one million Naira, Lendigo is quite different.

They have a strong lending power, meaning you can borrow more than one million Naira from them. If you are a small business owner who lacks the required financial stability to push your business to the next level, then you must lend from Lendigo; this is because you can receive up to the amount of N10,000,000(Ten Million Naira) from Lendigo.

It is quite different, especially if you compare them to most loan apps that will offer considerably less. Their repayment structure is also much clearer and understood, they have a nice interest rate that stands at just 3.5% monthly.

You’ll also be required to pay a one-time processing fee that’s not expensive, too. While you don’t need a salary account to begin your application, however, you’ll be required to bring some documents like your IDs. Your statement of account will also be required.

READ ALSO: Bank of Industry Loan Requirements: 7 Proven Strategies for Success

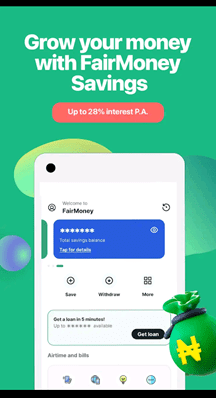

7. FairMoney Loan App

If you are looking for where to get a loan in Nigeria without Salary Account, the Fairmoney loan app is another one on our list that we highly recommend.

Fairmoney is about the First set of mobile loan apps that was among the first to be in Nigeria; ever since then, they’ve continued to grow, becoming a viable option for those looking to borrow money and sort their bills.

For you to start borrowing on Fairmoney, all you have to do is download their app from the Google Play Store or Apple Store depending on the gadget you are using.

Once Downloaded, set up your account by filling in the required details. For a start, you can borrow a minimum of N2000, you can as well borrow as much as N750,000 from the loan app.

8. Eyowo Loan App

Eyowo may not be as prominent in name as others I mentioned in this article, but trust me, they’re very reliable and trustworthy. If you want to borrow money without a Salary Account, consider going with the Eyowo Loan App.

To get registered, Download the app and fill in the necessary details; you have to register with your mobile number and start borrowing almost immediately.

Make sure you always pay your loans as at when due, doing this will automatically unlock more borrowing options for you as well as improve your credit score. The minimum amount you can borrow from Eyowo is N2000. You can also borrow as much as N500,000 from the Loan app.

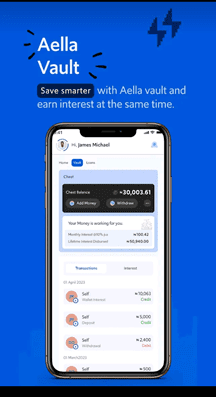

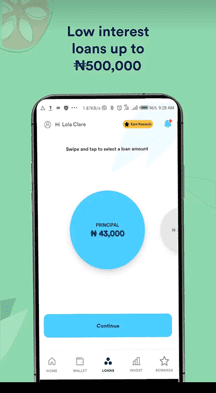

9. Aella Credit Loan App

Another popular option for those wishing to borrow money without having a salary account is the Aella Credit Loan App.

There are so many amazing options on Aella, so you are going to enjoy every bit of it. Aella makes sure Emergencies never take you unawares; their loan processing time is like a speed light, meaning you can get your loan credited to your bank account almost immediately.

Another advantage of the Aella Credit Loan App is the fact that you don’t even need to have your BVN before borrowing from them. You are not even required to provide collateral.

On Aella, you can borrow from the ranges of N1,500 to about One million Naira. To get the best out of Aella, try and make sure you always pay back when due.

10. Branch

Branch is obviously one of the biggest and most widely patronized loan apps in Nigeria.

It has all the necessary licensing and legalization from the Central Bank of Nigeria. If you have an emergency that requires urgent financial attention, you should consider borrowing from the Branch.

There are lots of financial activities that you can explore within the Branch loan app, You can perform transfers as well as make payments and buy recharge cards on Branch.

The minimum amount of money that you can borrow from the Branch is N1000. You can borrow as much as 500k from the Branch to sort your bills. The loan tenure on the Branch is within Two Months to One year.

1. Can I get a Loan without a Salary Account?

The answer to this question is YES. Indeed, you can get a loan without a salary account.

While other traditional banks like UBA, First Bank, Access Bank, Fidelity and Bank won’t give you loans without a Salary, some loan apps like Carbon, Fairmoney and Palmpay are willing to give you loans without a Salary Account.

Provided you meet their terms and conditions while also paying back as at when due, you’ll always be able to borrow from them whenever you feel like.

2. Can I use my Nin to get a loan?

Yes, You can use your National Identification Number (NIN) to get a Loan. However, it also depends on who’s lending you the money; many Fintech Banks like Palmpay, Opay and Kuda may ask for your NIN when lending you money. Other traditional banks equally request your NIN when giving out loans.

3. Which Banks give Loans Easily?

Most banks are ready to give you loans provided you meet their requirements. You can get loans from traditional banks. However, they’ll request that you provide a Salary Account.

Since a salary account is not accessible to everyone, it’ll be difficult to get a loan in traditional banks without a salary account.

On the other hand, you can easily get loans from Fintech Banks and loan apps without having a salary account, so it’s easier to get your Loans from Fintech Banks and loan apps than traditional banks.

4. Which App gives you a loan immediately in Nigeria?

Suppose you are looking to get an immediate Loan in Nigeria Through loan apps. In that case, You must consider apps like Okash(Opay), Palmpay, Carbon, and Aella. These apps can give you loans with a lightening speed.

Conclusion

As I said in my introduction, Getting loans in Nigeria without salary account is quite difficult, especially from our traditional banks.

However some other alternative options allow you to get a loan irrespective of whether you have a salary account or not.

In this blog post, I made sure to research some of the very best loan options that don’t require a salary account.

Now that you know all the options available, I hope you choose one from the numerous numbers on this list.