Here’s the ultimate guide on how to get a loan from GTBank. Easy process, competitive rates, and quick approvals for your financial needs.

GTBank loan is one of the highly sought financial products in Nigeria because it provides money for different purposes such as personal, business, and educational needs.

Applying for a GTBank loan is easy and can be initiated by means of a USSD code, GTB website, or GTB mobile app. There are also other requirements such as having an active GTBank account, availing proof of income and high creditworthiness.

This article contains all the information on how to get a loan from GT Bank, such as the USSD code and requirements for which you need to apply for the loans.

Table of Contents

What to Know About GTBank Loan

Guarantee Trust Bank is one of the foremost banks in Nigeria, offering loans at competitive interest rates. This loan is being offered as a credit facility to individual or group customers, commercial customers, and corporate customers to meet their various financial needs.

This loan can be accessed for several purposes, including personal, education, healthcare, household loans and expansion loans in business.

With simple application procedures and wonderful terms of lending, the Guarantee Trust Bank Loan is an excellent bank loan for those who need loans in Nigeria.

How to Qualify for GTB Loan

Strategies That Will Improve Your Chances to Qualify for a GTB Loan:

Maintain a Healthy Account

Keeping your GTBank account healthy is also a way to strengthen your chances of receiving a loan with the bank. This may include settling outstanding fees and payments and adding money repeatedly without going over.

An up-to-date account clearly demonstrates that you appropriately manage your finances.

Establish a Favorable Credit History

One of the most important parts that most Nigerians ignore is the need to keep their credit scores as high as possible.

The best time to start building this history is now for those who have yet to open their credit profiles. This can be by getting a small credit card or making use of a small loan that is affordable to repay.

It is how to create a positive credit history, which is of great importance for other loans in the future.

Choose the Right Type of Loan

It is very important to choose the best type of loan that suits your financial needs. GTBank will provide you with different options in terms of loan types for your different requirements. If you are a salaried employee, a Salary Advance Loan gives you access to 50% of your monthly salary to pay for such incidental expenses as bills, medical emergencies, or repairs in the interim.

It is usually deducted from your salary the following month; therefore, it is very convenient for temporary relief. If you are a salary earner or a self-employed professional, the Quick Credit option is your best bet.

Loans between 6 and 12 months are therefore ideal for urgent direct personal needs or increased capital for businesses not requiring collateral, as well as a loan in Nigeria without a salary account. It extends loans of up to ₦5 million.

For the business person, GTBank’s Business Loans are available for the operation, expansion, or purchasing of inventory. For access to the loans, collateral as well as a guarantor may be required, depending on the size and purpose of the borrowings.

There are also certain packages, such as overdrafts or asset financing, that come along with the loans for greater flexibility to accomplish the business goals.

Meet the Eligibility Criteria

GTBank has stipulated eligibility conditions for each type of loan, which borrowers must meet for the repayment. In general, applicants should be in the following age category: must be between 18 to 60 years of age.

The lower extreme is for legal compliance, whereas the upper extreme conforms to a normal working age or income-earning capability of the borrowers.

One should keep in mind that salaried applicants must be employees of organizations in GTBank’s approved employment list, by which they also specify loans such as ‘Salary Advance’ and ‘Quick Credit’ for salaried persons.

On the other hand, business loan applicants should prove their businesses have been registered legally and have been operating for a minimum period, which is generally between 12 months.

Prepare the Necessary Documents

As a way of expediting the process or even shortening the waiting time for a loan application, all the required documents should be ready beforehand.

Most important among these documents is a valid, government-issued ID-for example, an International Passport or Driver’s License or National ID card as evidence to prove identity.

For proof of residential address, a recent utility bill has to be provided. The bill may be from electricity, water, or phone bills and should be no older than three months. Also needed are bank statements covering the last three to six months showing your income flow and spending habits. For most business owners, this includes business account statements.

Proof of income will be required for salary earners, who may either attach their latest pay slips or provide a confirmation letter from their employer. Tax clearance certificates or audited financial statements are among the documents self-employed individuals should provide.

Loan Application

Ensure that your loan application is well-detailed and comprehensive before taking it to GTBank. Verify that you have all other documents, such as identity documents, proof of income, and, if necessary, an appropriate business plan.

Advantages of a GTBank Loan

There are several benefits of acquiring a GTBank loan. Some of these benefits include:

- Supporting availability: A GTBank loan provides access to capital which can assist individuals or businesses in supporting their endeavours.

- Facilitated repayment schedule: The loans at GTBank come with facilitated repayments, thus making it possible for the borrowers to repay in time.

- Fast Approval: The GTB loans fast approval, so borrowers can always have instant access to the required amount.

- Lower interest rates: The loan beneficiaries will have an easy time repaying the loan since GTB loans come with lower interest rates.

- Easy process: You can apply for a GTB loan both online and offline, with really easy steps to follow.

How to Get a Loan from GTBank: Discover the Best Loan Options Today

Follow these simple steps to understand how to get a loan from GTBank:

- Select the loan type you need: GTB gives several loan types, for example, small business loans, salary advance loans, and personal loans, among others. Choose the one that fits your needs and conditions best.

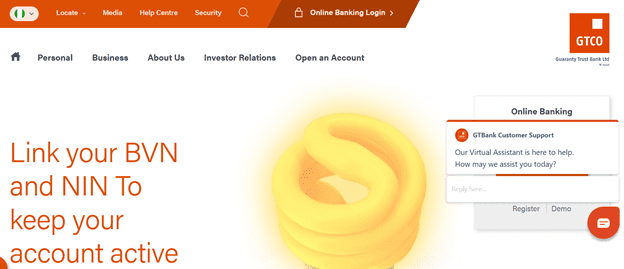

- Visit the GTB website: Navigate to the section “Loans” at the GTB website. There, you can find out more about the various kinds of loans to be provided by GTB.

- Select your loan: After selecting the type of loan you would like to apply for, read carefully the conditions.

- Fill out the application: After deciding on a certain loan, you may now fill out the application form online. Be sure you input all relevant information and attach the accompanying documents.

- Submit Application: After filling out the application, submit the application and observe the progress of GTB on your submission.

- Contact GTB Again: GTB will notify you with details of your loan offer should your application be successful; do not seek the end of those inquiries from GTB again if you have more queries or concerns.

Types Of GT Bank Loans And How to Apply

Salary Advance

GTBank Salary Advance will allow you to take up to 50% of your monthly salary in Advance for emergencies. The Advance is for government and commercial employees whose salaries are operated through GTBank.

A salary overdraft, “Salary Advance”, is offered to customers at GTBank in Nigeria for temporary overdraft purposes based on salary.

How to apply for a salary advance from GTBank

There are many ways through which customers of GTBank can apply for a salary advance: Online Banking, USSD, and through GTWORLD.

Application using GTWORLD for GTBank Advance Salary Loan

- Access the GTWorld Mobile App using your User ID and password.

- Select “Application for Loan”.

- Select Pay Advance from the list.

- Fill in the appearing form regarding loan amount, account to credit, and secret response.

- Click Continue.

- Type the token code to complete the request and complete.

Application through USSD to access a GTBank advance loan

These steps can be followed in applying for a Gtbank salary advance through USSD:

- Dail *737*8*2#

- Enter the required amount.

- To verify, enter your USSD transaction PIN or the last four digits of your debit card.

- After processing the loan application and having it approved, wait for approval.

Use Internet Banking to apply for a GTBank advance loan.

- Log on to Internet Banking using your user ID and password.

- Click Salary Advance under Quick Loan.

- Select “New Request.”

- Fill in the necessary details on the form, such as loan amount, tenor, and account to credit.

- Agree with the terms and conditions by checking the “Click Here to Agree” box.

- Then, choose “Continue” after answering your secret question.

- Type in the “Token Code.”

- Select “Submit.”

School Fees Advance

One of the ways that a parent can get a loan in Nigeria is through GTBank’s School Fees Advance for coverage of children’s tuition. This lending facility is available to employees of reputable commercial or government organizations who also deposit their salaries with GTBank.

How to Apply

- Fill in the employer undertaking and application form.

- Provide credit insurance and attach the school fees invoices.

- Ensure GTBank is the domicile of your terminal benefit or, instead, secure a corporate guarantee.

Requirements for the School Fees Advance

- Post-dated, signed cheque

- ID validity, including a driver’s license, a national ID, or an international passport.

- For guarantees of the loan two different external guarantors must come forward with valid IDs like a BVN, four passport pictures, identity cards, and a letter of intent.

- Utility bill (within the last three months.)

Quick Credit

It’s a short-term borrowing product suited to salary earners in dire need of cash. You can borrow from N5,000 up to N5 million with complete flexibility in terms of repayment not exceeding 12 months. The interest charge of 2.75% a month making it one of the best loan apps in Nigeria with low interest rates.

Generally speaking, GTbank is one of the few conventional commercial banks that issue soft loans to its clients. For such customers who select the option of soft loans, they get to have loan repayment deadlines longer than average and interest rates lower than usual.

Lending under this category is particularly targeted at customers with low earnings. GTbank has provided this soft loan option through the QUICKCREDIT loan service. Instant loans are made available to both sole proprietors and wage workers by Gtbank Quick Credit for the purpose of availing easy lending services.

It offers interest rates that are slightly less than the market average and allows a grace period of six to twelve months. This service has been made available to interested and qualified account holders so that they can access the money at once and pay it back through monthly equal instalments.

These loans are also available to applicants who have outstanding amounts owed to other banks on Remita.

How to Apply For Quick Credit

- This loan request can be made by valid clients using the GTbank loan code or the quick loan code *737*51*51#.

- Online loan requests can also be made via several GTbank mobile banking channels, including GTworld, internet banking, and the GTbank mobile app.

MaxAdvance

MaxAdvance is a personal loan for workers of selected governmental agencies and commercial organizations whose salaries are credited to GTBank.

How to Apply for MaxAdvance

- Ensure your salaries are domiciled at GTBank.

- Submit requisite documents, including the employer undertaking form.

MaxAdvance Loan requirements:

- Pre-signed, post-dated checks

- stamped account statements for 3 months

- A valid ID such as a driver’s license, national ID, or international passport.

MaxPlus

MaxPlus is for platinum clients who require a larger borrowing facility. This loan has amortization schedules adjustable at rates from N6 million to N50 million.

How to Apply for MaxPlus

- Submit a MaxPlus application along with your employer’s undertaking.

- Your salary account should be domiciled with GTBank.

Computer Acquisition Scheme

A loan facility that is specifically designed for serving corps members by GTBank is the Computer Acquisition Scheme. Under the scheme, corps members can obtain loans to purchase equipment such as laptops/mobile phones, which serve as enhancers of skills and learning during their service year.

How to Apply For the Computer Acquisition Scheme

- Complete the forms as required by employer undertaking and application

- Ensure domicile with GTBank for your NYSC allowance.

GTMortgage

GTBank’s GTMortgage is specifically designed to help its customers acquire residential properties in a few selected Nigerian cities. With regard to such mortgages, the terms will be so flexible that they will accommodate different financial situations.

GTMortgage requirements:

- Salaries or business proceeds of applicants should be domiciled with GTBank.

- Confirm employment with reputable organizations within one month of working with the current employers.

- The property that will be financed should be found within approved areas, low- and medium-density locations like Lagos, Abuja, Port Harcourt, and all state capitals.

- A completed GTMortgage application form.

- Title documents of the property.

- Offer letter to sell the property from the vendor.

- Valuation report from a GTBank-approved estate valuer.

- Search report from GTBank’s Legal Group.

- Duly completed GTMortgage Employer Undertaking form.

How can I borrow money from GTBank?

Borrowing from the bank happens through any of the various loans it has on offer, like QuickCredit, Salary Advance, and MaxAdvance, to mention just a few. For instance, you can apply through USSD via *737*51*51# or the GTWorld app and instantly get money after approval with QuickCredit.

What is the code for the GTB quick loan?

To apply for a loan through USSD, please dial *737*51*51# on your mobile device. By this, you can get your quick cash in a limited time.

Which bank gives loans easily?

Among the premier institutions offering quick and easy loans, such as QuickCredits and Salary Advance loans, are GTBank. Other popular banks providing fast loans in Nigeria also comprise Access Bank, which has its Loan packages, among many others.

How do I qualify for a loan on gt bank?

To qualify for a GTBank loan, you need:

An active GTBank account.

Minimum monthly income of ₦10,000 for salary earners or ₦20,000 for non-salary earners.

Good credit history.

Individuals from ages 18 up to 59 years.

How do I check if I qualify for a loan?

Examine Loan Prerequisites: Compare your credit score, income amount, and employment status with the lender’s requirements.

Utilize Online Resources: You can either check eligibility with USSD codes like GTBank’s *737# or employ an online loan calculator.

Visit the Lender: Go to the branch network or speak with customer support for consultation. Displays: Submit all required materials, such as payslips and ID, as proof of income.

What code can I use to borrow money from GT Bank?

The process of borrowing money from GTBank is very easy. You can use your mobile phone to dial *737*51*51#.

Once that is done, the next step would be following the automated prompts on your phone to apply for Quick Credit loans.

How much can GTBank borrow me?

The amount GTBank is willing to lend will depend on the category of loan, as well as the level of income or credit standing and repayment ability of the individual. For example:

Quick Credit: Up to ₦5 million while repayment occurs over 6-12 months.

Salary Advance: Up to 50% of your net monthly salary.

Mortgage Loans: Higher possible amounts depending on the value of the property for purchase.

Final Words

GTBank has many loan products that meet personal, educational, and business purposes. The repayment periods are flexible, the interest rates are very competitive, and the loan application process is straightforward through USSD codes, mobile apps, and Internet banking. In other words, it has never been so easy to source financial assistance.

Whether for business expansion, education, or personal expenditure, GTBank has something for you. Start making your loan application now, and take one huge step toward achieving your financial goals with one of the most trusted financial institutions in Nigeria.