Looking for the best loan apps? Check out the top 10 loan app in Nigeria, providing fast, secure, and flexible loan options.

Whether during financial difficulties or emergencies, many individuals today seek loans for personal use and business purposes to settle bills and cover expenses. Today, loans have fallen out of the exclusive reserve and responsibilities of banks.

Many lending platforms and institutions now offer quick and easy access to small and medium-sized loans, instant payment, low annual interest rates and adequate repayment time frames. These platforms are safe and reliable and operate from the easy access to a mobile app.

Today, I’m going to show you the top 10 best loan app in Nigeria

Table of Contents

Top 10 Loan App in Nigeria to Solve Your Financial Needs Fast

ALAT

Nigeria’s first-ever fully digital bank is the first on this list of best loan apps in Nigeria. It is a simple and entirely digital platform that grants quick, instant loans without any form of paperwork. Alat does not require a visit to a physical location and response time between loan acceptance and loan disbursement is in minutes.

Alat Loan also offers a range of services, such as the device lending offer and the goal-based loan, which allows you to receive a loan towards a specific goal or towards getting your preferred device or gadget. The interest rate is also designed entirely to help the user.

Salary earners can receive about 50,000 naira and even up to four million naira within hours and will have between three months to 24 months to pay back with only a 2 percent interest rate per month on a reduced balance basis

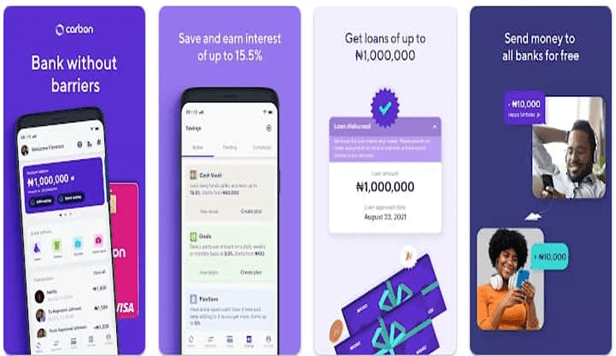

CARBON

Previously known as Pay Later, this simple lending platform gives access to loans within minutes. It provides short-term loans that help you cover immediate expenses and emergencies. You can request and receive a loan effortlessly without any documentation, not even a loan application letter is required. All that is required is your bank verification number (BVN) to ascertain loan credit.

With this app, you can receive up to 20 million naira with interest rates from 5 to 15 percent.

BRANCH

Branch is another reliable loan app that allows you to receive up to 200,000 naira worth within 24 hours with a minimal amount of 1000 naira. Repayment is within 4 to 40 weeks, and the loan attracts varying interest rates depending on the amount of the loan and the user’s repayment history.

No collateral or documentation is needed to access a loan with this platform. All you need is your phone number and bank verification number, and you are good to go.

PALM CREDIT

Borrowing from the Palm credit app is easy and can be done in a quick minutes. It has a straightforward service that allows users of the app to have access to instant loans worth 2,000 naira to 100,000 naira.

Individuals who will qualify for the loans must, however, be 18 years old and above. The app also offers rewards to users who refer others to the loan service.

AELLA CREDIT

Aella credit focuses on employee lending and allows its users to receive quick loans with a monthly interest rate of six percent to 20 and requires loan repayment within three months. Aella Credit also provides other financial services like investments, bill payments and affordable insurance services

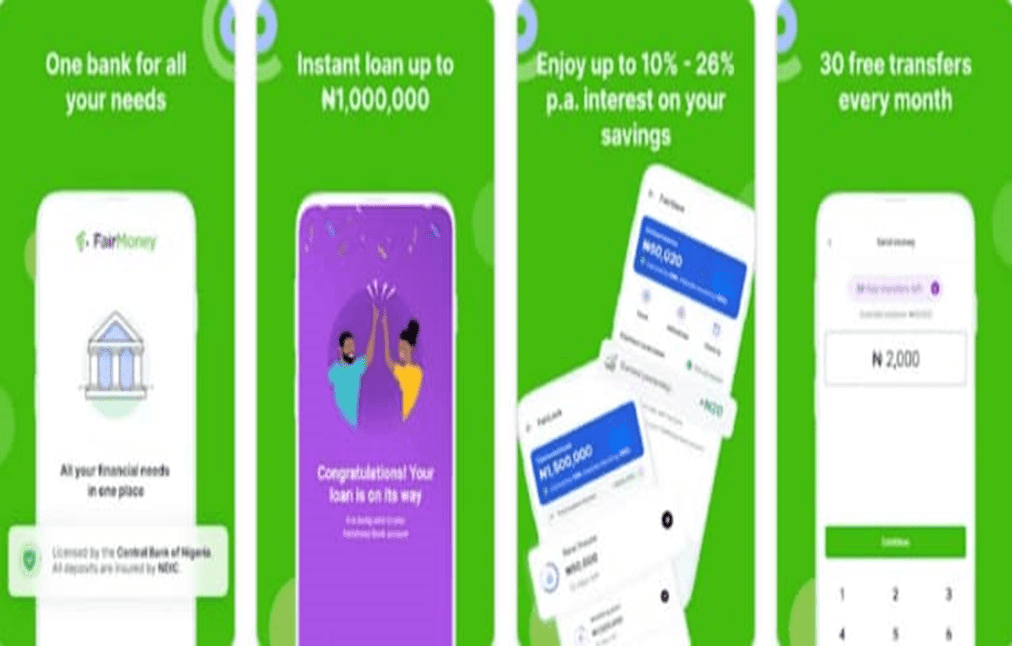

FAIR MONEY

Fair money app is among the best loan Apps in Nigeria due to their good service. All you need to do for a fast and easy application process is to download the app on your Google Play Store, receive your money without collateral and repay between a period of 15 days or one month. You should know that there will be some terms and conditions attached so check that before you apply for the loan.

Apart from giving out loans, fair money also offers the airtime recharge and paying of bills services on their app.

OKASH

Okash, an affiliate of the Opay app, is also another easy to use and good loaning app. To apply for the Okash loan, only BVN is needed. There are no complicated documents needed.

Okash is a subsidiary of Opay and was once included in the Opay app. Presently, Okash is one of the stand-alone loan apps in Nigeria, which means you can download and install just the loan app via the Play Store. It provides access to loan amounts of up to 50,000 naira with no collateral, although the maximum loan

the amount you could receive differs.

QUICK CHECK

Quickcheck is a modern lending platform that can never be left on my list of loan apps for Nigerians, either for individuals or small businesses. According to the platform, users can access quick loans of up to 30,000 naira without any collateral for a duration of either 15 or 30 days.

The more loans you take and repay on time, the higher your credit score and you gain access to even higher amounts. It’s

definitely one of the best loan apps in Nigeria.

KWIKMONEY MIGO

The only thing you need is your smartphone, and your SIM registered to your bank account. You don’t need any documentation to get your loans out in a few minutes.

The earlier you repay your loan, the higher the rate of money you can borrow. The next time you are on the platform, you can visit Quick Money Migo’s official website to process the loan within seconds using only your phone number and get the money straight into your bank account. You have 14 days to 30 days to return the loan.

SPECTA

Just like Alet, Specta is owned and managed by a financial institution sterling and does not require any collateral guarantor or bank visit to access quick loans, irrespective of your occupation or bank.

You can access a loan amount of up to five million naira to meet your financial needs. The app can be downloaded on the play store and has other interesting packages for you. For more details about special loans, you can check them on their official website.

Conclusion

These are the top 10 best loan apps in Nigeria. If you find this informative, please give a nice comment and also endeavor to share this article as well as go through other similar articles you would like and be updated in this blog.

Here are some frequently asked questions about the top 10 best loan apps in Nigeria:

Which loan app can l borrow up to a million naira?

You can get up to a million naira from several loan apps, as stated in this article. Some of these loan apps include FairMoney, Aella Credit, Quick Cash, and Alat by Wema. But these largely depend on your credit score and loan history on these loan apps

How much can I borrow from Fair Money as a first-time user?

The amount you can borrow from fair money as a first-time user depends on your credit history. Even though they advertise up to a million naira loan, the amount you would receive as a first-time user varies due to other loan factors

Does Branch give a loan?

Yes, Branch offers a loan and sends payment directly to your bank account within a short period. Although qualifying for a loan as a first-time user largely depends on your creditworthiness

How can I qualify for a loan from these loan apps?

To qualify for a loan from these loan apps mentioned in this article or other loan apps, you have to first be a resident of Nigeria, have a valid means of identity and have a bank verification number ( BVN). Also importantly, you should as well have a good credit record